We have various pictures about Fee free atm for cash app card ready in this website. You can get any images about Fee free atm for cash app card here. We hope you enjoy explore our website.

Currently you are reading a post about fee free atm for cash app card images. We give some images and information connected to fee free atm for cash app card. We always try our best to present a post with quality images and informative articles. If you cannot find any ideas or images you are looking for, you can use our search feature to browse our other post.

Fee Free Atm For Cash App Card. There are also 40,000 surcharge free atms nationwide where you can get cash with your wisely ®️ pay card. If you don�t have the pnc mobile app [2] download it in the app store or google play: Choose a color for the card. This is a fixed fee.

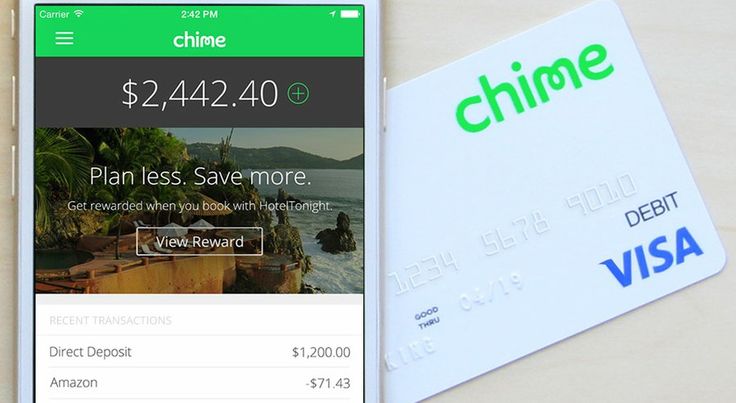

Chime Banking Banking services, Visa debit card, Banking app From pinterest.com

Chime Banking Banking services, Visa debit card, Banking app From pinterest.com

Cash support free atm withdrawals. Here are the fees* dependent on where your card was issued: Tap “get free cash card.”. There are instances where cash app reimburses cash app users when they withdraw at atms using their cash card. Green dot® network cash reload fees and limits apply. In some cases, the atm is free (it won’t add a surcharge), but your bank will charge you for using a “foreign” atm.

Conclusion despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction.

Once you have successfully activated free atm withdrawals, each. Your branch debit card may be used for cash back at merchants / businesses who support it. Here are the fees* dependent on where your card was issued: If you don�t have the pnc mobile app [2] download it in the app store or google play: Tap “get free cash card.”. Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements.

Source: pinterest.com

Source: pinterest.com

Enter your address and first and last name. Sign into the pnc mobile app and select atm access. Other online banks such as simple or chime have great options for atm usage. Sign the card by tapping “tap to customize.”. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card.

Source: pinterest.com

Source: pinterest.com

Say you take cash out of the atm twice per month. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Check with your bank or credit union to see if you qualify. If your card was issued in europe or the uk:

Source: pinterest.com

Source: pinterest.com

You can take out money for free twice a month — as long as it’s under 200 gbp/eur. You can never have too many options. Once you have successfully activated free atm withdrawals, each. Enter your address and first and last name. Choose a color for the card.

Source: in.pinterest.com

Source: in.pinterest.com

Say no to ridiculous atm fees, and yes to free withdrawals. There are instances where cash app reimburses cash app users when they withdraw at atms using their cash card. Choose a color for the card. Cash app users who receive qualifying direct deposits that total up to $300 plus get reimbursed for every 3 atm withdrawals per 31 days or a full month. Please note, each individual merchant / business may control cash back transactions such as amount, fees incurred, and other restrictions.

Source: pinterest.com

Source: pinterest.com

Tap the cash card icon. 8 simply use your porte debit card for $0 fee withdrawals. The maximum amount of money cash app users can withdraw per month at an atm using their cash card is $1,250. Some fees, like atm charges, will be reimbursed — up to 3 times per month and up to $7 per withdrawal — if you receive at least $300 in direct deposits to your cash app account each month. Tap “get free cash card.”.

Source: pinterest.com

Source: pinterest.com

8 simply use your porte debit card for $0 fee withdrawals. Sign the card by tapping “tap to customize.”. Choose a color for the card. Check with your bank or credit union to see if you qualify. With current, you can bank with no atm fees and instantly find a location near you on the atm locator map in our app.

Source: pinterest.com

Source: pinterest.com

Cash app users who receive qualifying direct deposits that total up to $300 plus get reimbursed for every 3 atm withdrawals per 31 days or a full month. As you use atm locators, keep in mind that some of them may show that atms will cost money to use. You can go to any participating bank and withdraw all of your money to the penny. Sign into the pnc mobile app and select atm access. Conclusion despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction.

Source: pinterest.com

Source: pinterest.com

There are also 40,000 surcharge free atms nationwide where you can get cash with your wisely ®️ pay card. Say you take cash out of the atm twice per month. Once you have successfully activated free atm withdrawals, each. Please note, each individual merchant / business may control cash back transactions such as amount, fees incurred, and other restrictions. Need the closest atm on your next trip?

Source: pinterest.com

Source: pinterest.com

Choose a color for the card. Cash app account holders can request a card through the app by following these steps: Once you have successfully activated free atm withdrawals, each. Green dot® network cash reload fees and limits apply. For overdraft, transaction is declined and no fee is charged.

Source: pinterest.com

Source: pinterest.com

You can go to any participating bank and withdraw all of your money to the penny. Free atm withdrawals cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Choose whether to show the account’s $cashtag on the card. Unemployment insurance deposits also qualify for enabling atm reimbursements. Sign into the pnc mobile app and select atm access.

Source: pinterest.com

Source: pinterest.com

Check with your bank or credit union to see if you qualify. Need the closest atm on your next trip? 8 simply use your porte debit card for $0 fee withdrawals. Green dot® network cash reload fees and limits apply. You can never have too many options.

Source: pinterest.com

Source: pinterest.com

With current, you can bank with no atm fees and instantly find a location near you on the atm locator map in our app. Tap the cash card icon. Cash support free atm withdrawals. Please note, each individual merchant / business may control cash back transactions such as amount, fees incurred, and other restrictions. But after that, we’ll charge you 0.50 gbp/eur per transaction.

Source: pinterest.com

Source: pinterest.com

You can take out money for free twice a month — as long as it’s under 200 gbp/eur. As you use atm locators, keep in mind that some of them may show that atms will cost money to use. Your branch debit card may be used for cash back at merchants / businesses who support it. Please refer to your card fee schedule. You can take out money for free twice a month — as long as it’s under 200 gbp/eur.

Source: pinterest.com

Source: pinterest.com

If you don�t have the pnc mobile app [2] download it in the app store or google play: Please refer to your card fee schedule. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Once you have successfully activated free atm withdrawals, each. Other online banks such as simple or chime have great options for atm usage.

Source: pinterest.com

Source: pinterest.com

Enter your address and first and last name. If you don�t have the pnc mobile app [2] download it in the app store or google play: Please note, each individual merchant / business may control cash back transactions such as amount, fees incurred, and other restrictions. Cash support free atm withdrawals. Please refer to your card fee schedule.

Source: pinterest.com

Source: pinterest.com

In some cases, the atm is free (it won’t add a surcharge), but your bank will charge you for using a “foreign” atm. Check with your bank or credit union to see if you qualify. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Cash app account holders can request a card through the app by following these steps: Please note, each individual merchant / business may control cash back transactions such as amount, fees incurred, and other restrictions.

Source: pinterest.com

Source: pinterest.com

Other online banks such as simple or chime have great options for atm usage. Free atm withdrawals cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. In some cases, the atm is free (it won’t add a surcharge), but your bank will charge you for using a “foreign” atm. Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. Choose whether to show the account’s $cashtag on the card.

Source: pinterest.com

Source: pinterest.com

As a consumer, you gain access to the allpoint network through your financial services provider. Say no to ridiculous atm fees, and yes to free withdrawals. Your branch debit card may be used for cash back at merchants / businesses who support it. Sign the card by tapping “tap to customize.”. If you don�t have the pnc mobile app [2] download it in the app store or google play:

Any registered user can submit their favorite wallpapers found from the internet to our website. All materials used in our website are for personal use only, please do not use them for commercial purposes. If you are the owner of uploaded image above, and you do not want them to be here, please give a report to us.

Please promote us by sharing this article about fee free atm for cash app card to your social media like Facebook, Instagram, etc. Thank you.