We have various images about Fee free atm for cash app in this article. You can find and download any images about Fee free atm for cash app here. We hope you enjoy explore our website.

Currently you are viewing a post about fee free atm for cash app images. We give some images and information connected to fee free atm for cash app. We always try our best to present a post with quality images and informative articles. If you cannot find any posts or photos you are looking for, you can use our search feature to browse our other post.

Fee Free Atm For Cash App. The simplest solution is to visit your bank or credit union when you need to withdraw cash, although that’s not always the most convenient option. Other fees apply to the bank account. Atm.com® is a free service with no monthly or annual fee for either our web services or mobile app, and helps you earn both active and passive income as dividends (as defined below, data dating dividends, reward dividends, and the colony data dividends are collectively referred to as “dividends”) in numerous ways, without atm.com selling your personal information (our limited rights to share your. Atm fees on cash card.

Pin on Travel Tips From pinterest.com

Pin on Travel Tips From pinterest.com

Instapay send (bank to bank transfer) from banks where there is no fee 3. The simplest solution is to visit your bank or credit union when you need to withdraw cash, although that’s not always the most convenient option. Say no to ridiculous atm fees, and yes to free withdrawals. Please refer to your card fee schedule. For overdraft, transaction is declined and no fee is charged. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card.

Ask a friend with a gcash account to help you out using send money:

It’s your money and you’re going to have to fight to keep more of it in your wallet. To find the nearest atm, visit the locations section of usbank.com or use the u.s. However, there’s no fee to send money from your cash app balance or bank account, even if you send money to someone in the u.k. Viewing + changing your atm / cash back limit preferences. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Ask a friend with a gcash account to help you out using send money:

Source: pinterest.com

Source: pinterest.com

There is a maximum atm / cash back withdraw limit of $400 / day total from the branch card. Payment service, so it isn’t a solution if you’re trying to send money to friends and family across. Say no to ridiculous atm fees, and yes to free withdrawals. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Cash app charges a 3% fee if you send money from a credit card.

Source: pinterest.com

Source: pinterest.com

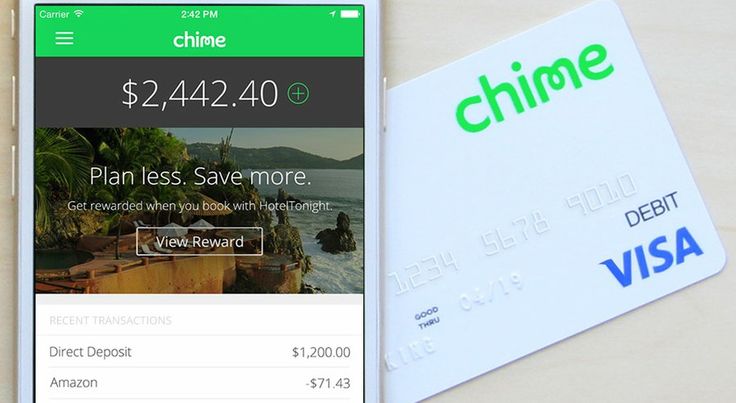

Your bank’s atm should be free for you to use, but customers from other banks most likely have to pay fees at the same machines. Ask a friend with a gcash account to help you out using send money: Atm fees on cash card. Some fees, like atm charges, will be reimbursed — up to 3 times per month and up to $7 per withdrawal — if you receive at least $300 in direct. Other online banks such as simple or chime have great options for atm usage.

Source: pinterest.com

Source: pinterest.com

Cash app users who receive qualifying direct deposits that total up to $300 plus get reimbursed for every 3 atm withdrawals per 31 days or a full month. Need the closest atm on your next trip? Despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction. The simplest solution is to visit your bank or credit union when you need to withdraw cash, although that’s not always the most convenient option. Atm fees on cash card.

Source: pinterest.com

Source: pinterest.com

Cash app users who use their cash app cash card to withdraw at any given atm are charged a fee of $2. 8 simply use your porte debit card for $0 fee withdrawals. Some fees, like atm charges, will be reimbursed — up to 3 times per month and up to $7 per withdrawal — if you receive at least $300 in direct. To find the nearest atm, visit the locations section of usbank.com or use the u.s. Find it in your porte app.

Source: pinterest.com

Source: pinterest.com

2 it�s easy to find moneypass atms in your area. Standard transfers on the app to your bank account take two to three days and are free, while instant transfers include a 1.5% fee. You can never have too many options. Payment service, so it isn’t a solution if you’re trying to send money to friends and family across. There is a maximum atm / cash back withdraw limit of $3,000.00 / month total from the branch card.

Source: pinterest.com

Source: pinterest.com

Standard transfers on the app to your bank account take two to three days and are free, while instant transfers include a 1.5% fee. Atm.com® is a free service with no monthly or annual fee for either our web services or mobile app, and helps you earn both active and passive income as dividends (as defined below, data dating dividends, reward dividends, and the colony data dividends are collectively referred to as “dividends”) in numerous ways, without atm.com selling your personal information (our limited rights to share your. Cash app users who use their cash app cash card to withdraw at any given atm are charged a fee of $2. Find it in your porte app. Payment service, so it isn’t a solution if you’re trying to send money to friends and family across.

Source: pinterest.com

Source: pinterest.com

Despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction. Please refer to your card fee schedule. Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month.

Source: pinterest.com

Source: pinterest.com

Other online banks such as simple or chime have great options for atm usage. To find the nearest atm, visit the locations section of usbank.com or use the u.s. Payment service, so it isn’t a solution if you’re trying to send money to friends and family across. Once there, enter your location and select the atm checkbox filter for a list of nearby u.s. Need the closest atm on your next trip?

Source: pinterest.com

Source: pinterest.com

Standard transfers on the app to your bank account take two to three days and are free, while instant transfers include a 1.5% fee. It’s your money and you’re going to have to fight to keep more of it in your wallet. Visit business insider�s homepage for more stories. Neither green dot bank nor stash offers overdraft services. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month.

Source: in.pinterest.com

Source: in.pinterest.com

Payment service, so it isn’t a solution if you’re trying to send money to friends and family across. There is a maximum atm / cash back withdraw limit of $400 / day total from the branch card. As a consumer, you gain access to the allpoint. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Payment service, so it isn’t a solution if you’re trying to send money to friends and family across.

Source: pinterest.com

Source: pinterest.com

Need the closest atm on your next trip? It’s your money and you’re going to have to fight to keep more of it in your wallet. 2 it�s easy to find moneypass atms in your area. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Bank customer, you also have access to transact at moneypass network atms without a surcharge fee.

Source: pinterest.com

Source: pinterest.com

There are instances where cash app reimburses cash app users when they withdraw at atms using their cash card. The simplest solution is to visit your bank or credit union when you need to withdraw cash, although that’s not always the most convenient option. Cash app users who receive qualifying direct deposits that total up to $300 plus get reimbursed for every 3 atm withdrawals per 31 days or a full month. 2 it�s easy to find moneypass atms in your area. You can never have too many options.

Source: pinterest.com

Source: pinterest.com

Please refer to your card fee schedule. Instapay send (bank to bank transfer) from banks where there is no fee 3. Payment service, so it isn’t a solution if you’re trying to send money to friends and family across. There is a maximum atm / cash back withdraw limit of $3,000.00 / month total from the branch card. Your bank’s atm should be free for you to use, but customers from other banks most likely have to pay fees at the same machines.

Source: pinterest.com

Source: pinterest.com

Cash app users who use their cash app cash card to withdraw at any given atm are charged a fee of $2. Ask a friend with a gcash account to help you out using send money: Visit business insider�s homepage for more stories. Standard transfers on the app to your bank account take two to three days and are free, while instant transfers include a 1.5% fee. Neither green dot bank nor stash offers overdraft services.

Source: pinterest.com

Source: pinterest.com

There is a maximum atm / cash back withdraw limit of $3,000.00 / month total from the branch card. Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. Need the closest atm on your next trip? For overdraft, transaction is declined and no fee is charged. Viewing + changing your atm / cash back limit preferences.

Source: pinterest.com

Source: pinterest.com

Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Cash app charges a 3% fee if you send money from a credit card. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. 8 simply use your porte debit card for $0 fee withdrawals. There are instances where cash app reimburses cash app users when they withdraw at atms using their cash card.

Source: pinterest.com

Source: pinterest.com

Standard transfers on the app to your bank account take two to three days and are free, while instant transfers include a 1.5% fee. Visit business insider�s homepage for more stories. Say no to ridiculous atm fees, and yes to free withdrawals. Ask a friend with a gcash account to help you out using send money: Atm.com® is a free service with no monthly or annual fee for either our web services or mobile app, and helps you earn both active and passive income as dividends (as defined below, data dating dividends, reward dividends, and the colony data dividends are collectively referred to as “dividends”) in numerous ways, without atm.com selling your personal information (our limited rights to share your.

Source: pinterest.com

Source: pinterest.com

Cash app users who receive qualifying direct deposits that total up to $300 plus get reimbursed for every 3 atm withdrawals per 31 days or a full month. 2 it�s easy to find moneypass atms in your area. There is a maximum atm / cash back withdraw limit of $3,000.00 / month total from the branch card. Cash cards work at any atm, with just a $2 fee charged by cash app. Despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction.

Any registered user can submit their favorite pictures found from the internet to our website. All materials used in our website are for personal use only, please do not use them for commercial purposes. If you are the author of uploaded image above, and you do not want them to be here, please give a report to us.

Please support us by sharing this post about fee free atm for cash app to your social media like Facebook, Instagram, etc. Thank you.