We have various images about Chime to cash app limit in this article. You can download any images about Chime to cash app limit here. We hope you enjoy explore our website.

Currently you are searching a post about chime to cash app limit images. We give some images and information connected to chime to cash app limit. We always try our best to present a post with quality images and informative articles. If you did not find any ideas or photos you are looking for, you can use our search feature to browse our other post.

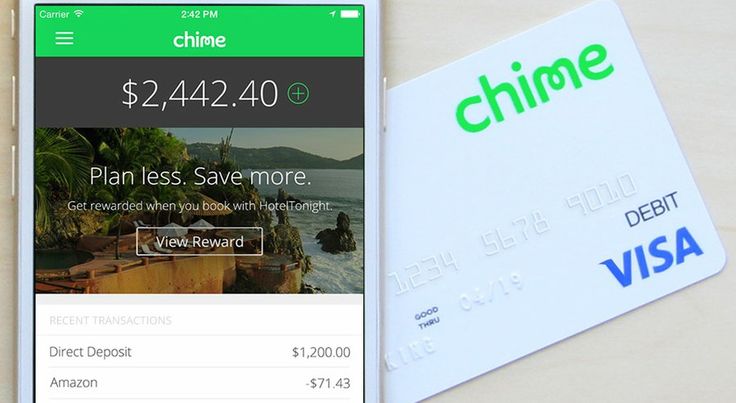

Chime To Cash App Limit. According to chime’s explanation, you can transfer from your external bank account to your chime spending account: The app can be found on any mobile device or in your chime online account. You can add up to $1,000 every 24 hours for a maximum of $10,000 every month. Enter the cash app details such as name, phone number, and email address.

Mobile Banking Money Transfer From pinterest.com

Mobile Banking Money Transfer From pinterest.com

Next, you need to tap on your profile button and select the ‘add bank� option. You will need a chime spending account and payroll direct deposit of $200. You’ll be navigated to a page with the routing number and account number needed by your employer. Reload your apple card and transfer to a different bank Enter the cash app details such as name, phone number, and email address. Here you�ll be presented with a list of banks.

Chime money withdrawal limit via chime atm card:

You’ll be navigated to a page with the routing number and account number needed by your employer. Click pay and the money will move to the cash app account. Your limit will be displayed to you within the chime mobile app. You will need a chime spending account and payroll direct deposit of $200. You can add up to $1,000 every 24 hours for a maximum of $10,000 every month. Need to send a paper check?

Source: pinterest.com

Source: pinterest.com

A single day, but you’ll have to make the number of transactions up to $500 cash. Chime allows you to withdraw $500 at one transaction. Chime has made setting up direct deposit easy. But, like any other bank, chime too has an atm withdrawal limit. The chime visa ® debit card is issued by the bancorp bank or stride bank pursuant to a license from visa u.s.a.

Source: pinterest.com

Source: pinterest.com

All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but may be later eligible for a higher limit of up to $200 or more based on member�s chime account history, direct deposit frequency and amount, spending activity. The app can be found on any mobile device or in your chime online account. Click pay and the money will move to the cash app account. Chime does not accept any cash deposits at its atms, but there are multiple ways to add money to your account. Banking services provided by the bancorp bank or stride bank, n.a., members fdic.

Source: pinterest.com

Source: pinterest.com

And may be used everywhere visa debit cards are accepted. You can start to withdraw even in. You can make up to 3 deposits every 24 hours. Chime can increase your spotme allowance up to $200 at its discretion based on your account history. Find chime and tap the icon.

Source: pinterest.com

Source: pinterest.com

Clicking “move money” in the mobile app. Chime can increase your spotme allowance up to $200 at its discretion based on your account history. Your limit will be displayed to you within the chime mobile app. Here you�ll be presented with a list of banks. For joint stimulus check make sure both of your signatures appear on the back of the check.

Source: pinterest.com

Source: pinterest.com

To join the credit builder waitlist, go to the chime app under settings and follow the instructions. But, like any other bank, chime too has an atm withdrawal limit. You need first to link your chime account to your cash app one. You can add up to $1,000 every 24 hours for a maximum of $10,000 every month. Sign the back of your paper check, then write “ for deposit to chime only” under your signature.

Source: pinterest.com

Source: pinterest.com

The chime visa ® debit card is issued by the bancorp bank or stride bank pursuant to a license from visa u.s.a. You have to be a chime member to join the waitlist and get early access to credit builder. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but may be later eligible for a higher limit of up to $200 or more based on member�s chime account history, direct deposit frequency and amount, spending activity. Find chime and tap the icon. You will need a chime spending account and payroll direct deposit of $200.

Source: pinterest.com

Source: pinterest.com

Find chime and tap the icon. Plus, there is no limit to the number of checks you can send each month. You can check your spotme limit in the mobile app. Next, you need to tap on your profile button and select the ‘add bank� option. But, like any other bank, chime too has an atm withdrawal limit.

Source: pinterest.com

Source: pinterest.com

Chime allows you to withdraw $500 at one transaction. You can make up to 3 deposits every 24 hours. A single day, but you’ll have to make the number of transactions up to $500 cash. Open your chime account using your smartphone or computer. You can start to withdraw even in.

Source: pinterest.com

Source: pinterest.com

To do this, open up the cash app application on your phone. You’ll be navigated to a page with the routing number and account number needed by your employer. Open your chime account using your smartphone or computer. You can�t send large amounts of money with an unverified cash app account. $200 in maximum per day $1,000 in maximum per month

Source: pinterest.com

Source: pinterest.com

You will need a chime spending account and payroll direct deposit of $200. Your limit will be displayed to you within the chime mobile app. You’re not limited to how many checks you can send per day, but the monthly limit is $10000. Your limit will be displayed to you within the chime mobile app. If you got apple pay.

Source: pinterest.com

Source: pinterest.com

Your limit will be displayed to you within the chime mobile app. No limit to the number of times per day up to $2,500.00 per day* the following are all subject to the $2,500 maximum amount that can be spent using the card per day : Open the chime app, tap move money at the bottom of your screen, then tap. Enter the cash app details such as name, phone number, and email address. You need first to link your chime account to your cash app one.

Source: pinterest.com

Source: pinterest.com

Chime money withdrawal limit via chime atm card: A single day, but you’ll have to make the number of transactions up to $500 cash. If you got apple pay. To do this, open up the cash app application on your phone. You can add up to $1,000 every 24 hours for a maximum of $10,000 every month.

Source: pinterest.com

Source: pinterest.com

Next, you need to tap on your profile button and select the ‘add bank� option. You have to be a chime member to join the waitlist and get early access to credit builder. Need to send a paper check? Open your chime account using your smartphone or computer. You’ll be navigated to a page with the routing number and account number needed by your employer.

Source: pinterest.com

Source: pinterest.com

For joint stimulus check make sure both of your signatures appear on the back of the check. Chime does not accept any cash deposits at its atms, but there are multiple ways to add money to your account. You will receive notice of any changes to your limit. The chime atm withdrawal limit is $500 along with some conditions. Chime has made setting up direct deposit easy.

Source: pinterest.com

Source: pinterest.com

Find chime and tap the icon. Next, you need to tap on your profile button and select the ‘add bank� option. You need first to link your chime account to your cash app one. Clicking “move money” in the mobile app. You can�t send large amounts of money with an unverified cash app account.

Source: pinterest.com

Source: pinterest.com

You can make up to 3 deposits every 24 hours. You can start to withdraw even in. Your limit will be displayed to you within the chime mobile app. Ask the cashier to make a deposit directly to your chime spending account. A single day, but you’ll have to make the number of transactions up to $500 cash.

Source: pinterest.com

Source: pinterest.com

A single day, but you’ll have to make the number of transactions up to $500 cash. Chime has made setting up direct deposit easy. A single day, but you’ll have to make the number of transactions up to $500 cash. You will need a chime spending account and payroll direct deposit of $200. Here you�ll be presented with a list of banks.

Source: pinterest.com

Source: pinterest.com

Chime money withdrawal limit via chime atm card: To do this, open up the cash app application on your phone. No limit to the number of times per day up to $2,500.00 per day* the following are all subject to the $2,500 maximum amount that can be spent using the card per day : Your limit will be displayed to you within the chime mobile app. You can�t send large amounts of money with an unverified cash app account.

Any registered user can post their favorite pictures found from the internet to our website. All materials used in our website are for personal use only, please do not use them for commercial purposes. If you are the owner of posted image above, and you do not want them to be here, please give a report to us.

Please help us by sharing this page about chime to cash app limit to your social media like Facebook, Instagram, etc. Thank you.